Introduction: Why Cash Flow Is Crucial for Medical Practices

For any small or large medical practice, consistent cash flow is the key to sustaining operations, paying staff, and ensuring seamless patient care. However, many healthcare providers struggle with delayed payments, insurance claim denials, and increasing patient financial responsibility.

This is where Revenue Cycle Management (RCM) plays a vital role. A well-optimized RCM process ensures timely payments from insurers and patients, reduces claim rejections, and improves overall financial health.

In this comprehensive guide, we will explore how RCM can improve cash flow for medical practices, the challenges clinics face, and the best practices to optimize revenue cycles.

1. What Is Revenue Cycle Management (RCM)?

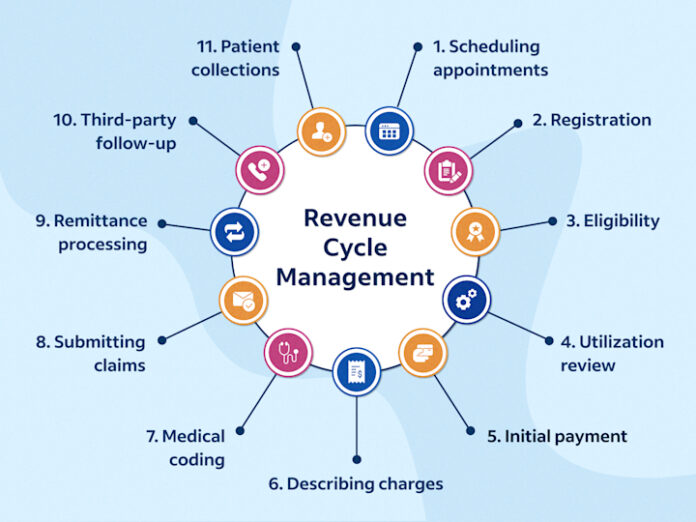

Revenue Cycle Management (RCM) refers to the end-to-end financial process of managing a patient’s medical service from appointment scheduling to final payment collection.

Key Stages of RCM

Patient Registration & Insurance Verification – Ensuring coverage before treatment.

Medical Coding & Charge Capture – Assigning correct billing codes for services.

Claims Submission & Processing – Sending claims to insurers for reimbursement.

Payment Posting & Reconciliation – Matching payments to patient accounts.

Patient Billing & Collections – Managing out-of-pocket payments.

By optimizing each stage, practices can streamline revenue flow and reduce financial bottlenecks.

2. The Role of RCM in Improving Cash Flow

2.1 Faster Insurance Reimbursements

Many practices face cash flow issues due to slow payments from insurance companies. An efficient RCM process ensures:

- Fewer claim denials by verifying eligibility before services are rendered.

- Faster claim approvals by submitting error-free, properly coded claims.

- Quick re-submissions for rejected claims through automated denial management.

Impact: Practices receive insurance payments on time, reducing revenue delays.

2.2 Reduced Claim Denials & Rejections

Did you know?

Up to 25% of medical claims are denied on the first submission due to coding errors, missing information, or payer policy violations.

RCM solutions help by:

- Automating coding accuracy with AI-driven medical coding tools.

- Tracking claim statuses in real-time to address rejections proactively.

- Implementing predictive analytics to prevent errors before submission.

Impact: Practices lose less revenue due to denied claims, boosting cash flow stability.

2.3 Optimized Patient Payment Collections

With the rise of high-deductible health plans (HDHPs), patients now owe more out-of-pocket costs. Poor patient billing management leads to:

- Unpaid bills

- Lost revenue

- Delays in cash flow

RCM improves patient collections by:

- Offering transparent upfront pricing to avoid payment disputes.

- Using automated reminders via email, SMS, and patient portals.

Providing multiple payment options (credit card, installment plans, online payments).

Impact: More timely patient payments, resulting in a steady revenue stream.

2.4 Real-Time Financial Reporting & Analytics

Without financial insights: Practices struggle with cash flow unpredictability.

- With RCM analytics tools: Providers track revenue trends, claim success rates, and overdue payments.

RCM platforms offer:

- Revenue forecasting tools to predict cash flow fluctuations.

- Detailed reports on payer reimbursement trends to optimize collections.

- Automated alerts for outstanding payments to take immediate action.

Impact: Data-driven decisions help clinics maximize revenue & minimize losses.

2.5 Reduced Administrative Burden on Staff

Medical staff spend hours manually verifying insurance, coding claims, and chasing payments. This delays revenue collection and creates inefficiencies.

With an automated RCM system, practices can:

- Reduce manual claim processing by 50%.

- Eliminate billing errors using AI-driven automation.

- Free up staff time to focus on patient care instead of administrative tasks.

Impact: Fewer billing backlogs, faster payments, and improved operational efficiency.

3. Best Practices to Optimize RCM for Cash Flow

3.1 Verify Insurance Eligibility Before Services

Prevent denials before they happen!

- Use real-time insurance verification tools to check patient coverage before scheduling appointments.

- Automate co-pay collection at the time of service to avoid delayed payments.

Result: Fewer claim rejections, faster payments.

3.2 Streamline Medical Coding & Documentation

Common reason for claim denials? Incorrect medical coding.

- Train staff on ICD-10, CPT, and HCPCS codes.

- Use AI-based coding solutions to reduce manual errors.

- Implement charge capture tools to ensure all billable services are documented.

Result: Fewer coding errors, higher claim approval rates.

3.3 Leverage RCM Automation & AI-Driven Analytics

RCM technology can boost cash flow by 20%!

- Automate claims submission & tracking.

- Use AI-driven denial management to detect errors in advance.

- Implement chatbots for patient billing inquiries to reduce collection delays.

Result: Faster insurance approvals, fewer denied claims.

3.4 Improve Patient Payment Collection Strategy

50% of outstanding medical bills go unpaid due to poor billing transparency!

- Offer automated patient billing reminders.

- Implement online patient payment portals.

- Provide flexible financing options (installments, payment plans).

Result: Increased patient payment compliance, stronger cash flow stability.

3.5 Regularly Audit & Optimize RCM Workflows

Revenue leaks can occur if RCM workflows aren’t optimized regularly.

- Conduct monthly revenue cycle audits to track performance.

- Identify payer reimbursement delays and follow up aggressively.

- Optimize contract negotiations with insurers for better payment rates.

Result: A financially stable, well-managed revenue cycle.

4. How Small vs. Large Practices Benefit from RCM

| RCM Benefits | Small Practices | Large Practices |

|---|---|---|

| Faster claim processing | Essential for small staff | Crucial for handling high claim volumes |

| Automation reduces workload | Frees up front-desk staff | Reduces admin burden for billing teams |

| Better patient collections | Helps maintain cash flow | Reduces outstanding balances |

| Real-time revenue tracking | Prevents cash flow surprises | Improves multi-location financial management |

Regardless of size, RCM helps all medical practices streamline revenue and achieve financial success.

5. Final Thoughts: Why RCM Is Essential For Strong Cash Flow

A well-optimized Revenue Cycle Management system is the key to financial stability for small and large medical practices. By reducing claim denials, automating billing, and improving patient collections, clinics can achieve faster reimbursements, better revenue forecasting, and sustainable growth.

At ClinicBillingHelp.com, we provide expert insights, industry trends, and best practices to help healthcare providers navigate RCM challenges and improve their cash flow.

- Want to maximize revenue for your practice?

- Explore our expert RCM resources at ClinicBillingHelp.com.