Introduction: Why Accurate Medical Billing Is Essential

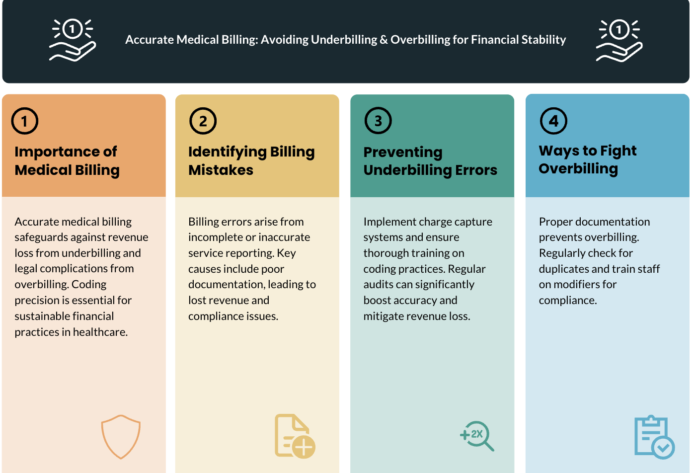

Medical billing errors—whether underbilling or overbilling—can severely impact a healthcare provider’s financial stability and compliance with regulations. Underbilling results in lost revenue when providers fail to bill for all services rendered. Overbilling can lead to insurance claim denials, audits, and legal penalties if providers charge for services not fully justified by documentation.

To maintain compliance and maximize revenue, medical practices must implement accurate billing processes that ensure all services are properly coded and reimbursed at the correct rates. This comprehensive guide will explore the risks of underbilling and overbilling, and provide proven strategies to improve billing accuracy, reduce claim denials, and ensure full reimbursement for your services.

1. Understanding Underbilling and Overbilling

What Is Underbilling?

Underbilling occurs when a provider fails to bill for all services performed or charges less than the correct reimbursement amount.

Common Causes of Underbilling:

- Missed charges due to incomplete documentation.

- Incorrect coding leading to lower reimbursement rates.

- Lack of knowledge about payer-specific rules.

- Failure to bill for additional services (e.g., follow-ups, consultations).

Impact of Underbilling:

- Significant revenue loss for the practice.

- Increased financial strain on operations.

- Lower claim reimbursement rates affecting long-term profitability.

What Is Overbilling?

Overbilling happens when a provider bills for services that were not performed, upcodes a procedure, or incorrectly charges higher than the allowed amount.

Common Causes of Overbilling:

- Upcoding – Using a higher CPT code than necessary.

- Billing for services not provided.

- Duplicate billing – Submitting multiple claims for the same service.

- Incorrect use of modifiers that increase reimbursement.

Impact of Overbilling:

- Increased risk of payer audits.

- Claim denials and penalties for fraudulent billing.

- Potential Medicare and insurance violations, leading to hefty fines.

2. How to Avoid Underbilling in Your Medical Practice

2.1 Implement a Charge Capture System

Why it matters: Missed charges occur when providers fail to document all billable services.

- Use Electronic Health Records (EHR) with automated charge capture to ensure no services go unbilled.

- Implement checklists for common procedures to help staff accurately track services provided.

- Regularly audit physician documentation to identify missing charges.

Impact:

Prevents revenue loss from underbilled services.

2.2 Train Staff on Correct Coding Practices

Why it matters: Inexperienced staff or outdated coding knowledge can lead to undercoded claims.

- Provide ongoing training on ICD-10, CPT, and HCPCS codes.

- Ensure coders stay updated on payer-specific reimbursement guidelines.

- Use AI-driven coding software to flag potential undercoding issues.

Impact:

Improves billing accuracy and ensures maximum reimbursements.

2.3 Verify Insurance Payer Rules

Why it matters: Different payers have unique billing policies, and failing to comply can lead to underbilling.

- Cross-check payer fee schedules before claim submission.

- Stay informed on Medicare, Medicaid, and private payer reimbursement rates.

- Use automated payer rule-checking tools to avoid claim underpayments.

Impact:

Ensures correct reimbursements based on insurer policies.

2.4 Conduct Regular Internal Billing Audits

Why it matters: Regular audits help identify patterns of underbilling before they affect revenue.

- Review claims and remittance reports monthly.

- Compare billed charges with actual services provided to catch missing revenue.

- Use third-party auditors to ensure unbiased assessments.

Impact:

Identifies revenue leaks and corrects them in real-time.

3. How to Avoid Overbilling in Your Medical Practice

3.1 Prevent Upcoding and Ensure Proper Documentation

Why it matters: Billing for higher-level services than what was provided is a common compliance issue.

- Ensure provider documentation supports the billed CPT codes.

- Implement coding review processes to check for upcoding errors.

- Use billing software with built-in compliance alerts.

Impact:

Prevents claim denials and legal risks.

3.2 Avoid Duplicate Billing Errors

Why it matters: Submitting multiple claims for the same service leads to claim rejections and penalties.

- Use billing software that flags duplicate claims before submission.

- Train staff to review patient encounter records carefully before billing.

- Regularly reconcile claims and payments to detect errors early.

Impact:

Reduces administrative costs and prevents insurance disputes.

3.3 Ensure Proper Use of Billing Modifiers

Why it matters: Incorrect use of modifiers can artificially inflate reimbursement amounts.

- Educate billers on the correct use of modifiers like -25, -59, and -91.

- Implement automated claim review systems that detect improper modifier usage.

Impact:

Prevents payer scrutiny and ensures legitimate reimbursements.

3.4 Stay Updated on Compliance Regulations

Why it matters: Failing to follow Medicare, Medicaid, and commercial insurance billing guidelines can result in audits.

- Subscribe to CMS and insurance payer updates.

- Conduct annual compliance training for all billing staff.

- Hire a compliance officer or consultant to review billing policies.

Impact:

Reduces legal liability and ensures compliance with insurance guidelines.

4. The Role of RCM Software in Preventing Billing Errors

Using Revenue Cycle Management (RCM) software can significantly reduce billing errors by:

- Automating charge capture to prevent missed services.

- Ensuring real-time eligibility checks to avoid incorrect claims.

- Using AI-driven coding assistance to detect undercoding and overcoding.

- Providing denial management tools for quick claim resubmissions.

Best RCM Software for Medical Billing Accuracy:

- Kareo – Ideal for small clinics.

- Athenahealth – Great for automated compliance alerts.

- DrChrono – Best for integrated charge capture.

- AdvancedMD – Excellent for large practices.

Final Thoughts: Ensuring Billing Accuracy in Your Medical Practice

Preventing underbilling and overbilling is essential for financial stability, compliance, and trust with payers. By implementing:

- Accurate charge capture systems

- Regular billing audits

- Coding accuracy training

- RCM software solutions

Medical practices can maximize revenue while maintaining compliance with payer regulations.

At ClinicBillingHelp.com, we provide expert insights, software reviews, and best practices to help healthcare providers navigate complex billing challenges and optimize revenue cycle management.

Want to improve billing accuracy in your clinic?

Explore expert RCM resources at ClinicBillingHelp.com.