The healthcare landscape is continuously evolving. Payment models are shifting away from traditional fee-for-service (FFS) systems toward value-based care, where healthcare professionals share more accountability for patient outcomes and overall costs. In this context, bundled payments stand out as one of the key strategies for rewarding high-quality, cost-efficient care.

For small, independent practices, embracing this model can be both an opportunity and a challenge. On one hand, bundled payments can streamline reimbursement and promote better coordination of care. On the other hand, improper planning can expose smaller offices to financial risks they may not be prepared to manage. This guide offers an in-depth look at what bundled payments are, how they work, and the best ways for smaller healthcare organizations to adapt.

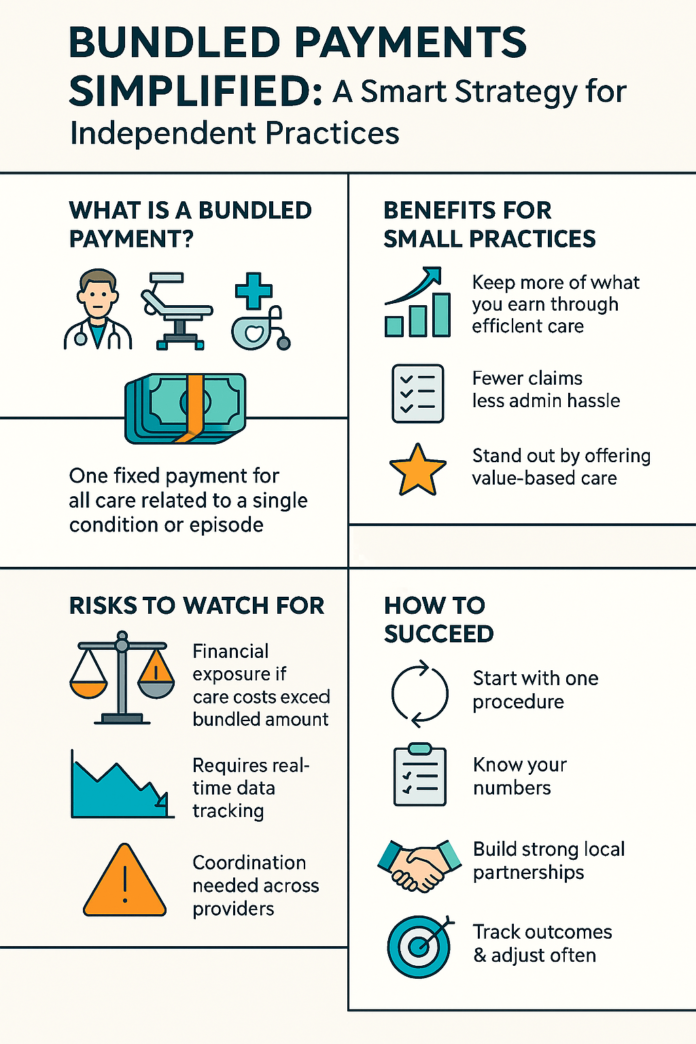

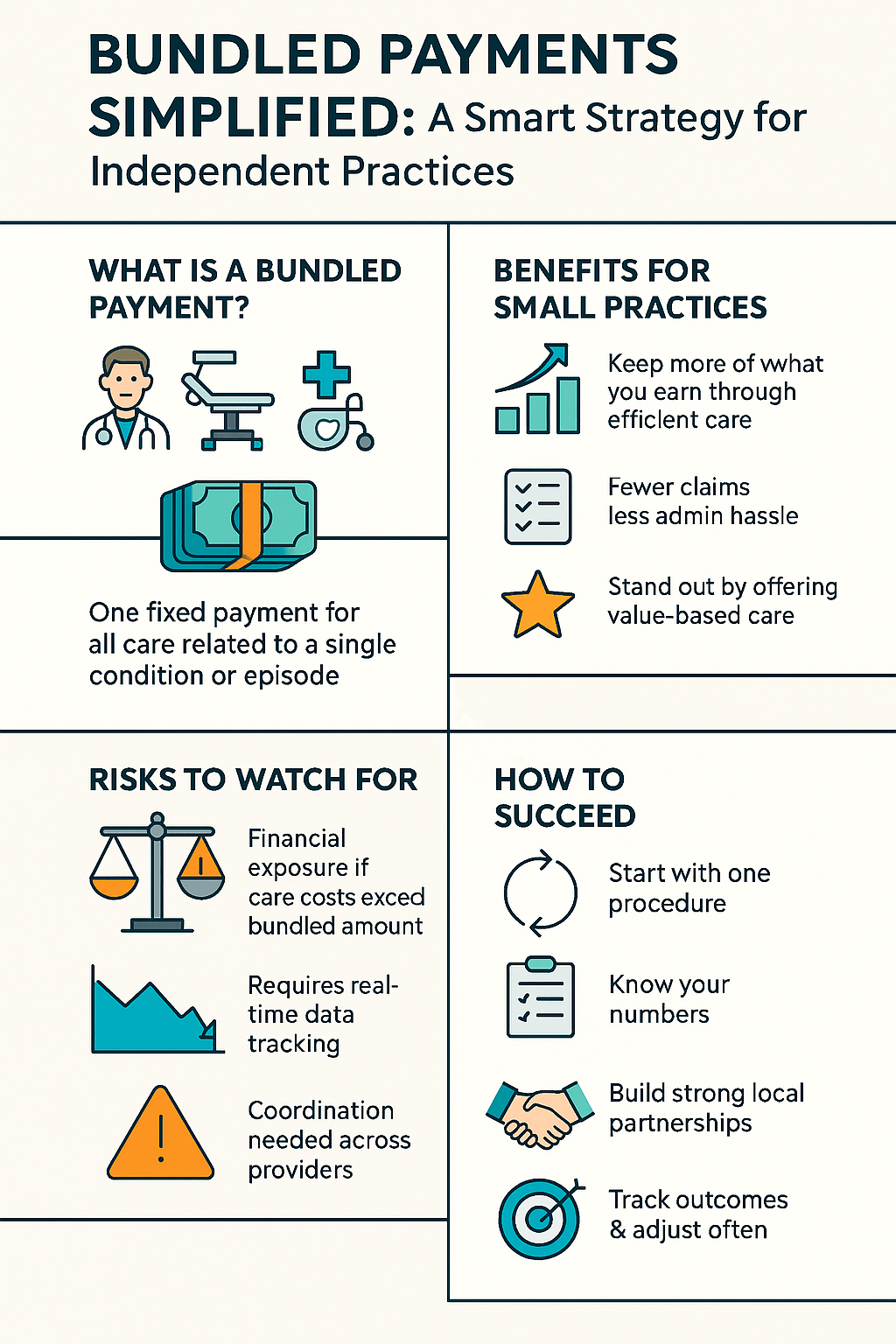

1. What Are Bundled Payments?

Bundled payments—sometimes called “episode-based payments” or “episode-of-care payments”—are a reimbursement model in which a single, predetermined price covers all the care and services related to a specific condition, episode of care, or procedure. Rather than billing multiple claims for each step (pre-operative tests, surgical procedures, post-operative rehabilitation, etc.), all these costs are aggregated into one payment.

This system stands in stark contrast to the traditional fee-for-service approach, where each separate service has its own claim and costs can escalate quickly. By adopting a bundled payment model, payers (including Medicare, private insurance companies, and self-insured employers) seek to create incentives for more coordinated, cost-effective care among various providers involved in a patient’s treatment journey.

1.1 Key Components of a Bundled Payment

- Episode Definition: The condition or procedure that triggers the bundle. For example, a hip replacement might include all related care from a certain number of days before the surgery to a fixed time frame following the surgery.

- Price Determination: A negotiated or benchmarked cost for all services within that episode.

- Risk Sharing: Providers take on financial risk. If total costs exceed the predetermined amount, the provider (or group of providers) may be responsible for the difference. Conversely, if costs are lower, the provider may keep some of the savings as profit.

2. The Growing Popularity of Bundled Payments

The concept of bundling services into one payment has been a key element in the movement toward value-based care. By incentivizing better outcomes at lower costs, bundled payments align the interests of payers, providers, and patients.

2.1 Medicare’s Role and Pilot Programs

Medicare has led the charge in popularizing bundled payments. Initiatives such as the Bundled Payments for Care Improvement (BPCI) and the Comprehensive Care for Joint Replacement (CJR) model have shown promising results, including:

- Cost Savings: Reductions in overall per-episode spending for conditions like joint replacements.

- Improved Outcomes: Lowered readmission rates and better patient satisfaction scores.

2.2 Wider Adoption in the Private Sector

Private payers have taken note of Medicare’s successes and begun rolling out their own bundled payment programs. Large employers, too, are negotiating direct contracts with healthcare systems to secure bundled rates for expensive or high-volume procedures such as cardiac surgeries and oncology care. The result is a growing ecosystem of providers and payers exploring bundling as a way to contain costs while rewarding quality and efficiency.

3. Why Bundled Payments Matter for Small Practices

For large hospital systems or established multi-specialty clinics, the shift to bundled payments may seem more natural. They often have the resources, staff, and data analytics to manage costs effectively. However, smaller practices frequently worry about whether they can absorb the financial risks and invest in the required infrastructure. Yet, bundled payments offer some notable advantages—even for smaller entities:

- Potential for Higher Profit Margins: By delivering more efficient, better-coordinated care, a small practice could keep more of the bundled payment as surplus rather than spending it on unnecessary services or repeated tests.

- Competitive Edge: Patients and payers increasingly seek providers who demonstrate better outcomes at lower costs. Participating in bundled payment arrangements can help a small practice stand out in the local market.

- Streamlined Administrative Work: Bundled payments reduce the complexities of multiple claims submissions. One negotiated price for an entire episode can simplify paperwork and accelerate reimbursements, if managed correctly.

4. Understanding the Risks Involved

Despite the potential upsides, the transition to a bundled payment model involves a range of financial and operational considerations for small practices.

4.1 Financial Risk and Exposure

In a traditional FFS framework, a practice gets paid for each service delivered. With bundled payments, you’ll receive a single, fixed amount to cover the patient’s entire episode of care, from initial consultation through follow-up. If complications arise or if additional visits or treatments become necessary, the excess cost may have to come out of the practice’s pocket. This downside risk can be intimidating for offices operating with limited cash flow or razor-thin margins.

4.2 Data and Analytics Requirements

Success in bundled payments requires tracking costs meticulously. Smaller practices may lack the robust electronic health record (EHR) systems or analytics tools that hospital systems have. Without real-time data on patient progress and resource utilization, it’s challenging to identify when a case is veering off course—and to intervene before costs escalate.

4.3 Coordination with Other Providers

For an episode that involves specialists, physical therapists, or imaging centers outside your immediate practice, you must align all stakeholders under the same cost and quality goals. Small practices may need to negotiate partnerships and formal care-coordination agreements with others to streamline the entire episode of care, not just their own piece.

5. Core Steps to Implement Bundled Payments Successfully

For small offices ready to take on a bundled payment arrangement, there are some foundational steps to consider.

5.1 Start Small and Focus on High-Volume or Routine Procedures

Rather than dive into multiple complex episodes, begin by identifying one or two procedures or conditions that:

- Occur frequently in your patient population.

- Have a predictable cost range and care path.

- Are feasible to coordinate among known partners, like a trusted specialist or rehab facility.

For instance, a small orthopedic practice might start by bundling knee arthroscopies or joint replacement episodes, working closely with a specific hospital and physical therapy group.

5.2 Conduct a Thorough Cost Analysis

Understanding your current costs and margins is crucial. Carefully assess your historical data:

- Direct Costs: Staffing, clinical supplies, equipment usage.

- Indirect Costs: Overhead like rent, utilities, and administrative tasks allocated to each service.

- Potential Complication Costs: Additional visits, readmissions, or extended recovery times.

With these insights, you can negotiate a bundled payment rate that covers your anticipated costs while offering the payer a compelling reason to contract with you.

5.3 Improve Care Coordination and Communication

Bundled payments thrive on smooth transitions between different points of care. In a small practice, you may need to formalize processes that previously were informal or ad hoc:

- Clear Referral Pathways: Use EHRs or shared documentation portals where feasible.

- Communication Protocols: Define how and when updates will be exchanged between the primary provider, specialist, and other care teams (like home health services).

- Patient Education: Ensure the patient understands every step of the treatment process, the importance of follow-up visits, and ways to minimize complications (e.g., proper wound care or medication adherence).

5.4 Establish Quality Metrics and Track Patient Outcomes

To succeed in a bundled payment environment, it’s not enough to simply “spend less.” You also must maintain or enhance the quality of care. Set clear, measurable quality metrics:

- Clinical Outcomes: Infection rates, complication rates, readmissions.

- Patient Experience: Satisfaction surveys, adherence to care plans, and timely follow-ups.

- Operational Efficiency: Average length of stay (if relevant), speed of scheduling follow-up appointments, or time to coordinate specialist visits.

6. Building Strong Partnerships

It’s unlikely that a single small practice can handle an entire episode of care alone, especially for more complex procedures. Strategic partnerships are essential.

6.1 Collaborate with Specialists

A primary care practice can form a bundled payment program for managing diabetes or other chronic conditions by collaborating with endocrinologists, nutritionists, or even mental health professionals. Likewise, a small cardiology office might partner with imaging centers and post-operative rehab clinics.

Contractual Clarity: Spell out responsibilities, data-sharing obligations, and revenue splits in a legally binding agreement. This clarity minimizes disputes and sets mutual goals.

6.2 Engage Payors and Employers Directly

Large self-insured employers sometimes contract directly with practices and hospital systems for bundled services. By building a track record of high-quality, cost-efficient care, you can pitch your practice to these employers as a trusted partner for specific episodes of care (e.g., advanced imaging, routine child check-ups, specialized chronic disease management).

7. Navigating Compliance and Regulations

Bundled payment programs often come with guidelines from government bodies like the Centers for Medicare & Medicaid Services (CMS). Meanwhile, private payers may have their own sets of rules and reporting requirements.

7.1 Federal Programs

- Medicare BPCI (Bundled Payments for Care Improvement): Includes four models targeting different care settings and episodes. Requirements can range from data reporting to quality measurement.

- CJR (Comprehensive Care for Joint Replacement): Focuses on lower-extremity joint replacement episodes. Participation might be mandatory or voluntary, depending on region.

7.2 Avoiding Fraud and Abuse Violations

When multiple providers coordinate in a bundled payment model, it’s crucial to ensure no arrangement is seen as a referral kickback or violates the Stark Law or Anti-Kickback Statute. Clear, transparent contracts and fair-market-value pricing typically alleviate these concerns.

7.3 HIPAA Considerations

Data sharing among multiple organizations requires strict adherence to HIPAA rules. If you’re exchanging protected health information (PHI) with specialists, rehab facilities, or third-party payers, ensure you have robust encryption, secure servers, and business associate agreements (BAAs) in place.

8. Technology and Data Analytics for Bundled Payments

A major challenge for small practices is effectively harnessing technology to monitor patient progress and costs. Fortunately, an expanding array of affordable and user-friendly digital tools can help.

8.1 Electronic Health Records (EHR) and Interoperability

- Real-Time Updates: EHRs can make data instantly accessible among the various providers involved in a patient’s care.

- Alerts and Reminders: Automated reminders for post-op checkups, medication refills, or therapy sessions help maintain continuity and prevent high-cost complications.

8.2 Predictive Analytics and Risk Stratification

Advanced analytics can help estimate which patients are at higher risk for complications, readmissions, or noncompliance. If you can target these high-risk groups for extra care coordination or follow-ups, you may reduce expenses and improve outcomes under bundled payment models.

Tip: While sophisticated analytics platforms can be expensive, many EHR systems now offer built-in dashboards that track key metrics. You don’t need a full data science team—just a willingness to learn how to interpret the available data and pivot your care strategies.

9. Training and Staff Engagement

Shifting to a bundled payment model impacts every role in the practice, from front-office scheduling to back-office billing. Without thorough staff buy-in and training, it’s nearly impossible to manage these arrangements successfully.

- Billing Staff: Must understand how to submit claims under a bundled fee structure. They should track additional codes or document outlier expenses for accurate record-keeping.

- Clinical Team: Doctors, nurses, and physician assistants need to appreciate how clinical efficiency and standardized protocols can reduce costs without sacrificing care quality.

- Support Staff: Receptionists, patient navigators, and administrative staff can assist with scheduling, data entry, and ensuring no steps fall through the cracks.

Consider offering ongoing education on the financial and quality goals of the bundled payment program. When all team members understand their role, they’re more likely to coordinate effectively and maintain the clinic’s profitability.

10. Monitoring and Continuous Improvement

A well-designed bundled payment strategy requires regular evaluation and refinements. The healthcare landscape evolves—costs rise, new treatments emerge, and payers adjust rules. Thus, it’s crucial to keep a close eye on performance and be ready to pivot.

10.1 Tracking Key Performance Indicators (KPIs)

Select metrics that align with your bundled payment contracts and your broader practice goals, such as:

- Per-Episode Profitability: Did the final cost of care remain below the bundled payment amount?

- Quality Indicators: Readmission rates, complication rates, patient satisfaction scores.

- Operational Efficiency: Turnaround time for consults and scheduling, claims submission accuracy, average time to reimbursements.

10.2 Evaluating Contract Renewals

Most bundled payment contracts are set for fixed periods. Near renewal, analyze your data. Have you met or exceeded the payer’s cost and quality benchmarks? Are you incurring too many out-of-pocket losses for certain patient populations? Use this information to negotiate more favorable contract terms or adjust the structure of the bundle.

11. Success Story: A Small Orthopedic Practice Embraces Bundled Payments

To illustrate how a modest-sized clinic can thrive under a bundled payment arrangement, consider the following real-world-inspired example:

Setting: A three-physician orthopedic practice in a semi-rural region.

Initiative: The practice partners with a local hospital and a private insurance company to offer a bundled payment for knee replacement surgery. The episode covers the surgery itself, a defined pre-operative workup period, and six months of follow-up care, including rehabilitation.

Implementation:

- They invest in advanced arthroscopic equipment and standardized clinical protocols to streamline care.

- They assign a care navigator to each patient, ensuring consistent follow-up calls and encouraging rehab attendance.

- They partner with a local physical therapy center, establishing a shared patient-tracking system.

Outcomes:

- Patient satisfaction rates climb, with fewer complications and readmissions.

- The practice negotiates a shared-savings arrangement: if costs remain below an agreed benchmark, the difference is split between the practice, the hospital, and the insurer.

- Over the first year, they reduced average spending per episode by 10% while boosting net revenue.

This example showcases how, with focused planning and strong alliances, smaller healthcare offices can thrive under bundled payment models.

12. Final Thoughts

Bundled payments are not a one-size-fits-all solution, but they represent a significant step toward reshaping how healthcare services are delivered and reimbursed. For small practices, these arrangements open doors to new revenue models and improved patient outcomes—provided you have a solid strategy, precise cost tracking, and robust partnerships.

Making the leap to bundled payments does involve risk. You must be willing to invest time, effort, and possibly capital to upgrade technology, train staff, and set up new care coordination mechanisms. Yet, the potential advantages—higher patient satisfaction, shared-savings bonuses, simplified administration—can make the endeavor worthwhile.

Key Takeaways:

- Plan Carefully: Start with a single high-volume service where you have a stable care pathway.

- Know Your Costs: Detailed cost accounting is essential for negotiating fair bundled rates and avoiding losses.

- Prioritize Care Coordination: Align with specialists, hospitals, or rehab centers to create seamless patient experiences.

- Manage Risks Proactively: Track real-time data to spot warning signs of patient complications or ballooning costs.

- Strive for Continuous Improvement: Adjust protocols and renegotiate contract terms as you gather performance data.

For small practices aiming to stay competitive in a value-based care world, bundled payments can be a powerful tool—one that not only stabilizes revenue streams but also elevates the quality of care you deliver to your community. By following the strategies and guidelines outlined here, your practice can successfully embrace bundled payments as a cornerstone of sustainable, patient-centered healthcare.