Payer audits are an inevitable part of the healthcare system. As insurance companies strive to curb unnecessary spending and prevent fraudulent activities, healthcare organizations must be prepared to demonstrate that their practices meet compliance regulations, coding standards, and contract terms. Whether you run a small private clinic or manage a large hospital network, preparedness can mean the difference between smooth audit findings and financial or legal repercussions. In this comprehensive guide, we will explore key aspects of payer audits and offer a detailed compliance checklist to help you build and maintain a robust audit-ready environment.

By following these strategies, you can not only improve your organization’s documentation and billing practices but also protect your revenue cycle, maintain patient trust, and uphold the highest standards of quality care. Below, you’ll find actionable steps, best practices, and tools you can use to keep your healthcare practice in full compliance and ready for any payer audit.

1. Understanding Payer Audits

1.1 What Is a Payer Audit?

A payer audit is an examination of a healthcare provider’s records and billing practices to ensure compliance with the payer’s policies, Medicare or Medicaid guidelines, and overarching federal and state regulations. These audits can be conducted by private insurance companies, government agencies like the Centers for Medicare & Medicaid Services (CMS), or third-party auditors contracted by payers.

1.2 Why Do Payer Audits Occur?

Audits are typically triggered for the following reasons:

- Billing irregularities: Unusual billing patterns, high volume of certain procedures, or frequent use of specific modifiers may prompt scrutiny.

- Random selection: Some payers randomly select providers to conduct routine audits, ensuring continuous checks across their network.

- Suspected fraud or abuse: Payers will investigate if they have reason to believe that fraudulent billing or coding is happening.

Ultimately, audits help maintain financial integrity and ensure patients receive appropriate, medically necessary treatments.

1.3 Potential Consequences of Failing an Audit

Failing a payer audit can lead to:

- Claim denials and recoupments: You may be required to repay reimbursements that a payer deems improper.

- Penalties and fines: Severe or repetitive compliance failures can lead to significant financial penalties.

- Exclusion from payer networks: In extreme cases, providers may be dropped from a payer network entirely, impacting patient volume and revenue.

- Legal repercussions: Fraud or abuse findings may result in lawsuits or criminal charges.

Staying prepared for a payer audit is not optional in modern healthcare; it is a fundamental aspect of a thriving, compliant practice.

2. Key Components of a Payer Audit

Before jumping into the specific steps of how to prepare for a payer audit, it’s important to understand the key areas these auditors will examine:

- Documentation Quality: Auditors look at patient charts, medical records, and documentation to ensure services were actually provided, medically necessary, and accurately recorded.

- Billing & Coding Accuracy: CPT, ICD-10, and HCPCS codes must be accurately assigned to align with the services rendered and the payer’s contract. Over-coding or under-coding can result in denials or penalties.

- Medical Necessity: Services must be justified based on accepted clinical guidelines and the patient’s condition.

- Compliance with Federal and State Regulations: This can include HIPAA compliance, OSHA requirements, as well as any specific state laws governing healthcare delivery.

- Contract Adherence: Healthcare organizations must align with the terms in their payer contracts, including prior authorization protocols, referral requirements, and timely filing limits.

Knowing these areas will help you structure a solid audit plan.

3. Building an Effective Compliance Program

A proactive and carefully designed compliance program is essential to safeguarding your practice. A strong compliance infrastructure provides a constant reminder to physicians, administrators, and support staff about the regulations and payer requirements that govern healthcare. Here are the main components of an effective compliance program:

- Compliance Officer: Designate a dedicated individual or a committee that oversees all compliance-related activities, including policy creation, audit preparation, and staff training.

- Policies and Procedures: Maintain up-to-date written policies that address billing, coding, documentation requirements, privacy regulations, and any specific payer guidelines.

- Training and Education: Conduct regular training sessions for staff and clinicians, ensuring everyone understands the latest compliance requirements, coding updates, and privacy regulations.

- Internal Audits: Schedule periodic self-audits or mock audits to identify and correct vulnerabilities before a real audit happens.

- Reporting Mechanism: Establish clear channels for staff to report possible compliance violations without fear of retribution.

A consistent compliance program not only helps your organization stay prepared for unexpected audits but also streamlines daily operations, boosting overall efficiency and patient satisfaction.

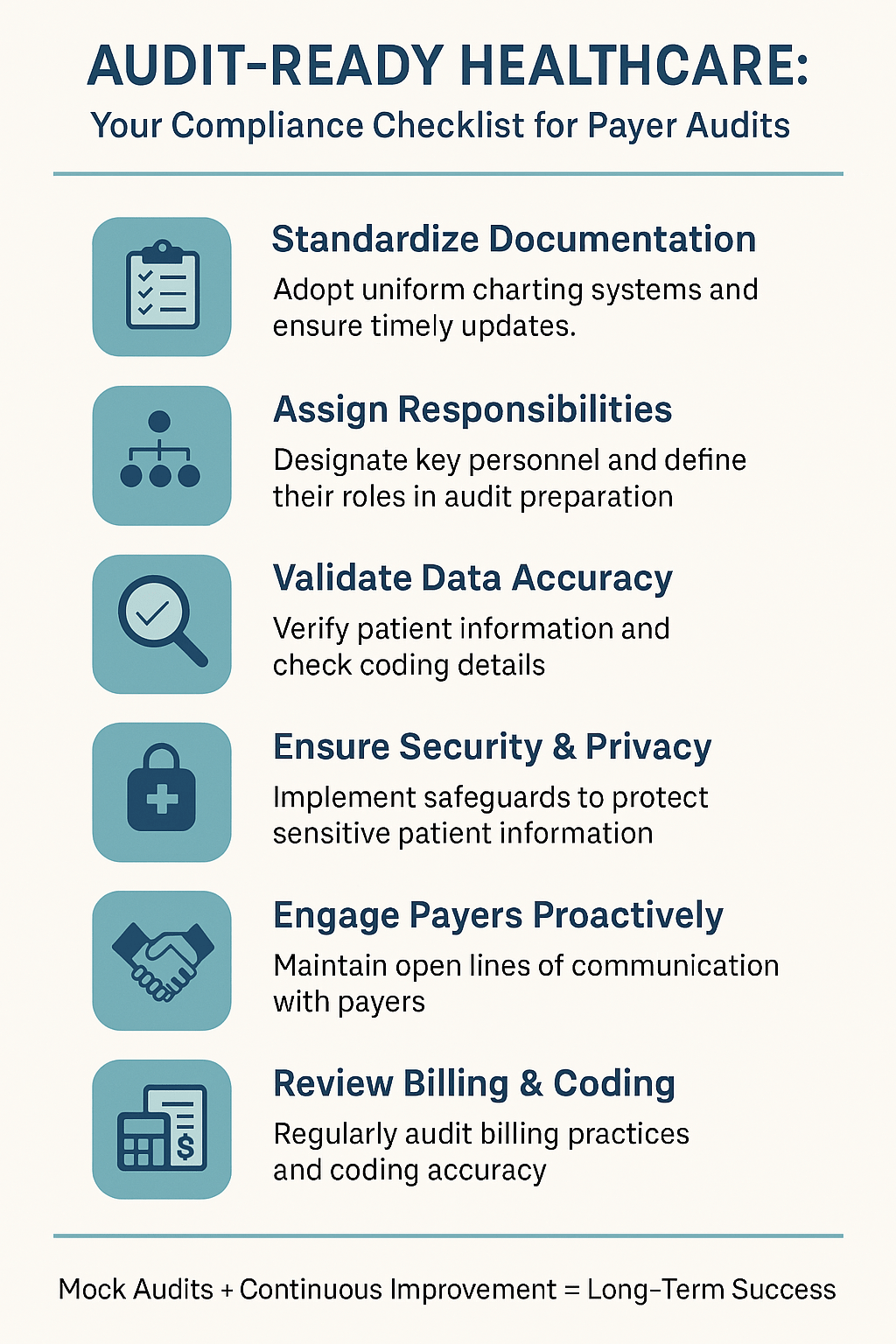

4. The Payer Audit Preparation Checklist

To help you navigate the complexity of payer audits, below is a step-by-step checklist outlining the most critical tasks and best practices to adopt. By following these guidelines, you can significantly reduce the risk of billing errors, claim denials, and other audit-related pitfalls.

4.1 Step 1: Organize and Standardize Documentation

Why it matters: Proper documentation is the backbone of any successful payer audit. Consistent, complete, and accurate charts and records help demonstrate medical necessity and compliance.

- Adopt a Uniform Charting System

- Use standardized forms and templates to ensure uniformity across your practice.

- Ensure every entry is dated, signed (or electronically authenticated), and legible.

- Implement EHR Optimization

- Customize your Electronic Health Record (EHR) system to guide clinicians with prompts or checklists for required data fields.

- Reduce free-text fields that may lead to omissions or inconsistencies.

- Maintain Timely Updates

- Train staff to record patient encounters in real-time or immediately after the encounter to avoid errors or omissions.

- Ensure that addendums are clearly labeled with the date and reason for modification.

- Document Medical Necessity Thoroughly

- Clearly outline the rationale for treatments or procedures.

- Integrate relevant test results, vital signs, and clinical impressions into the chart.

Checklist Tip: Periodically audit random patient charts to verify that the documentation meets payer standards and medical necessity requirements. Encourage staff to treat each entry as if it will be reviewed by an external auditor.

4.2 Step 2: Assign Clear Team Responsibilities

Why it matters: Efficient coordination prevents confusion and ensures that each audit-related task has a responsible owner.

- Identify Key Personnel

- Designate a compliance officer or a small team to coordinate audit responses and act as liaisons with auditors.

- Assign subject matter experts for billing, coding, clinical documentation, and IT security.

- Develop an Escalation Path

- Create a chain of command for reporting issues, from front-line staff to senior administrators.

- Clearly define who has the final say in disputes or uncertainties.

- Conduct Regular Meetings

- Schedule recurring “compliance huddles” or team meetings to review new payer policies, discuss recent internal audit findings, and address emerging concerns.

Checklist Tip: Document each team member’s role in a written compliance plan so responsibilities and accountabilities remain transparent and accessible.

4.3 Step 3: Validate Data Integrity

Why it matters: Inaccurate data—whether it’s patient demographics or coding details—can lead to claim denials and suspicion of fraudulent activity.

- Verify Patient Information

- Ensure demographic data, insurance details, and medical histories are accurately captured during registration or check-in.

- Implement a protocol for periodic data validation, especially for long-term patients.

- Review Coding Accuracy

- Cross-check codes for frequently performed procedures and diagnoses for accuracy and alignment with payer guidelines.

- Utilize coding software or reference tools such as the current year’s CPT, ICD-10, and HCPCS manuals.

- Monitor for Duplicate or Overlapping Claims

- Implement systems to flag potential duplicate claims or unusual frequency of procedures.

- Investigate and correct discrepancies immediately.

- Validate Electronic Claims Submissions

- Use clearinghouses or software that alerts you to potential coding errors or missing data before the claim is submitted.

Checklist Tip: Conduct periodic spot checks on submitted claims to confirm data accuracy. Early detection of errors can help you address systemic issues before an external payer audit.

4.4 Step 4: Safeguard Security and Privacy

Why it matters: HIPAA violations are a prime area of concern during payer audits. Ensuring that patient data is accessed and stored securely is vital.

- Implement Role-Based Access

- Limit EHR and billing software access based on job responsibilities.

- Require multi-factor authentication for remote or high-level access.

- Maintain Physical Security

- Store paper records in locked cabinets and restrict office access to authorized staff only.

- Shred or securely dispose of any physical records containing Protected Health Information (PHI) when no longer needed.

- Conduct Privacy Training

- Provide mandatory HIPAA training to all employees, including new hires, with annual refreshers.

- Emphasize the importance of not sharing passwords or leaving screens with PHI visible.

- Perform Security Risk Assessments

- Regularly review your IT infrastructure, from firewalls to encryption methods, to identify potential vulnerabilities.

- Document remedial actions to demonstrate ongoing compliance efforts.

Checklist Tip: Keep a log of all privacy-related training sessions and security updates. Documentation serves as evidence of proactive measures if a payer questions your privacy protocols.

4.5 Step 5: Foster Open Communication with Payers

Why it matters: Clear communication with payers can resolve minor issues before they spiral into larger disputes or audits.

- Understand Your Payer Contracts

- Review payer contracts periodically for updates, fee schedules, and changes in coverage policies.

- Ensure your billing department is aware of any nuances in the contract (e.g., pre-authorization requirements or negotiated rates).

- Maintain Contact Information

- Keep an up-to-date list of payer representatives or liaisons.

- Establish a protocol for escalating concerns if initial contact doesn’t resolve issues.

- Ask Questions Proactively

- If you encounter ambiguous rules or require clarification on claim denials, don’t hesitate to reach out for guidance.

- Document any written correspondence to maintain an audit trail of communications.

Checklist Tip: Quarterly check-ins with payer representatives can help you stay informed of policy changes, new documentation requirements, or potential risk areas.

4.6 Step 6: Review Your Billing and Coding Practices

Why it matters: Billing and coding discrepancies are the most common issues in payer audits. Taking a proactive approach can drastically reduce your risk.

- Update Coding Manuals Annually

- Stay current with annual code changes (CPT, ICD-10, HCPCS) and train staff on new codes.

- Remove outdated manuals and guides to avoid confusion.

- Perform Regular Internal Coding Audits

- Hire a certified professional coder or utilize a coding audit service for periodic reviews.

- Pay special attention to Evaluation and Management (E/M) codes, as they are frequently audited.

- Set Up Automated Edits

- Use your practice management or billing system’s built-in edits to catch common coding errors (e.g., mismatched diagnosis and procedure codes).

- Regularly update edit rules to align with the latest guidelines.

- Focus on High-Risk Areas

- Identify services with high denial rates or those flagged by payers as frequently misbilled.

- Provide targeted training and auditing in these high-risk areas.

Checklist Tip: Keep a record of all internal billing and coding audits, along with corrective action plans. If a payer questions your billing integrity, these records demonstrate that you are taking compliance seriously.

4.7 Step 7: Provide Ongoing Training and Education

Why it matters: Healthcare regulations and payer requirements evolve rapidly. Continuous staff education is essential to keep your organization agile and compliant.

- Schedule Routine Workshops

- Conduct quarterly or biannual workshops focused on updates in billing, coding, and compliance regulations.

- Invite guest speakers or consultants when new, complex rules are introduced.

- Leverage Online Training Tools

- Utilize e-learning modules for quick, cost-effective refresher courses.

- Administer quizzes and track performance to gauge staff competency.

- Encourage Certifications

- Support staff members who wish to obtain credentials like Certified Professional Coder (CPC) or Certified Coding Specialist (CCS).

- Offer rewards or recognition for employees who attain additional certifications.

Checklist Tip: Ensure that all training sessions are documented with attendee rosters, topics covered, and any materials distributed. This not only keeps employees accountable but also provides evidence of compliance-focused education during a payer audit.

5. Conducting a Mock Audit

A mock audit simulates a real payer audit to reveal any weaknesses in your processes. Here’s how you can conduct one effectively:

- Select a Representative Sample

- Choose multiple patient records from different service lines and payers.

- Include both routine and complex cases to get a comprehensive picture of your compliance.

- Assemble an Audit Team

- Involve your compliance officer, coding experts, and possibly external consultants for an objective review.

- Have each team member focus on their area of expertise, such as documentation, coding, billing, or privacy.

- Review Findings and Implement Corrections

- Share the results with relevant staff, highlighting both strengths and weaknesses.

- Develop corrective action plans for each deficiency, assigning clear deadlines and responsible parties.

- Follow Up

- Repeat targeted mini-audits to ensure corrective actions have been implemented effectively.

- Keep detailed records of improvements to show continuous compliance progress.

Conducting a mock audit isn’t just a dry run; it’s a powerful learning experience that helps your entire organization understand the complexities of payer audits and refine practices to minimize risk.

6. Common Pitfalls and How to Avoid Them

While each healthcare organization is unique, some pitfalls frequently arise during payer audits:

- Overlooking Minor Errors

- Small lapses in documentation or billing can accumulate, fueling suspicions of fraud or negligence.

- Prevention Strategy: Implement daily or weekly spot checks to catch minor issues before they scale.

- Inadequate Staff Training

- Uninformed staff members often create compliance risks by unintentionally coding incorrectly or mishandling PHI.

- Prevention Strategy: Maintain a robust training calendar and provide easy access to reference materials.

- Poor Communication

- Gaps in communication between administrative and clinical staff can lead to inconsistent documentation and billing errors.

- Prevention Strategy: Encourage interdisciplinary collaboration and schedule regular team meetings.

- Delayed Response to Payer Queries

- Failure to respond promptly to documentation or explanation requests can escalate minor issues into larger disputes.

- Prevention Strategy: Designate an audit response team and establish clear timelines for addressing payer concerns.

- Lack of a Formal Compliance Program

- Operating without a codified compliance plan leaves a practice vulnerable to regulatory changes and sudden audits.

- Prevention Strategy: Develop, maintain, and update a formal compliance plan that addresses the full scope of your organization’s needs.

By identifying and addressing these common pitfalls early, you can enhance your readiness for any audit scenario and reduce the risk of costly consequences.

7. Conclusion

Preparing for a payer audit may seem daunting, but a well-crafted strategy and ongoing vigilance can turn this challenge into an opportunity to strengthen your organization’s compliance, efficiency, and overall patient care. By organizing documentation, clarifying team roles, validating data, safeguarding security, nurturing open communication with payers, and regularly reviewing billing practices, you set the foundation for proactive audit readiness. Integrating continuous training and conducting mock audits further fortify your processes, ensuring you remain compliant in a dynamic and closely regulated healthcare environment.

Key Takeaways:

- Create a Culture of Compliance: Encourage everyone in your organization to value compliance as much as they do clinical excellence.

- Stay Proactive: Regular internal reviews and mock audits can spot issues before an external auditor does.

- Foster Collaboration: Audit readiness is a team effort, blending clinical documentation, administrative processes, and legal know-how.

- Keep Learning: Healthcare regulations and payer requirements are ever-evolving; consistent education is vital.

Ultimately, a solid compliance checklist is your best ally in preparing for a payer audit. By being diligent and forward-thinking, your healthcare practice can not only meet payer standards but also thrive under the most stringent scrutiny. The rewards are many: smoother operations, fewer denials, stronger patient trust, and a reputation for integrity that differentiates you from other providers. When payers come knocking, you’ll be ready to open the door with confidence.