Underpayments are a persistent challenge in the healthcare revenue cycle. In an ideal scenario, providers would submit a clean claim, and payers would reimburse exactly the agreed-upon amount—no more, no less. But in reality, coding complexities, contract nuances, and human errors often lead to lower-than-expected payments. When repeated across dozens or hundreds of claims, even minor underpayments can significantly erode a practice’s revenue.

If left unchecked, underpayments can create cash-flow constraints, disrupt daily operations, and diminish resources for patient care. That is why it’s vital for healthcare providers to understand how to handle underpayment disputes and appeals effectively. In this comprehensive guide, we’ll discuss why underpayments occur, how to detect them, and the practical steps you can take to dispute and resolve them. By following the strategies below, you can improve your reimbursements, maintain healthier finances, and ensure you’re paid fairly for the high-quality services you deliver.

1. Understanding What Constitutes an Underpayment

An underpayment arises when a payer reimburses a provider at a rate lower than what the contract stipulates or the service is worth. This can occur for several reasons:

- Payer Contract Discrepancies: Perhaps the fee schedule was not updated, or the payer uses outdated rates.

- Coding Errors: If the claim lacks accurate codes, modifiers, or supporting documentation, the payer might partially pay instead of outright denying.

- System Glitches: Software or data-entry errors—either at the payer’s end or your own—may cause claims to be processed incorrectly.

- Policy Changes: The insurance plan may have changed coverage policies without prior notification, leaving you unknowingly underpaid.

- Bundling or Downcoding: Payers might bundle multiple procedures into one or downcode a service to a lower reimbursement category.

Underpayments can be subtle, so it’s not always obvious that a claim has been under-reimbursed. A robust internal process that reviews payment against contracted rates is essential to detect these instances quickly.

2. The Financial and Operational Impact of Underpayments

Healthcare organizations must operate with tight margins, balancing overhead expenses, clinical staff salaries, insurance costs, and daily administrative responsibilities. Even small revenue leaks can:

- Strain Cash Flow: Delayed or partial payments disrupt the ability to make timely payroll and vendor payments.

- Increase Workload: Staff must spend extra time identifying, researching, and disputing underpayments instead of focusing on higher-value tasks.

- Erode Profitability: Over time, repeated underpayments chip away at net revenue, forcing some practices to reduce services or even turn away certain insurance plans.

Consequently, a proactive approach to detecting and appealing underpayments helps sustain the financial viability of your practice while improving relationships with payers.

3. Common Reasons for Underpayment Disputes

To formulate an effective response, you first need to identify the root cause of an underpayment. Here are some frequent culprits:

- Mismatched Contract Rates: Payers sometimes fail to update their systems to reflect newly negotiated rates. This oversight can lead to consistent underpayments.

- Incorrect CPT or ICD-10 Coding: Services might be accurately performed but incorrectly coded. This discrepancy often results in partial reimbursement if not recognized as an outright denial.

- Application of Multiple Procedure Discounts: If multiple procedures were performed in one session, the payer might apply a discount or incorrectly bundle the codes, resulting in underpayments.

- Failure to Recognize Modifiers: In certain cases, a modifier clarifies that the procedure was distinct or separate from another. If the payer ignores or misreads a valid modifier, your claim could be short-paid.

- Arbitrary Downcoding: Some payers downcode claims from higher-level evaluation and management (E/M) services to lower ones, thereby reducing payment.

- Inappropriate Bundling: Under the guise of “bundling,” payers may combine separate services into a single claim line with a lower combined payment.

4. Setting Up an Internal Monitoring System

A robust monitoring system is the backbone of detecting underpayments. Since billing and reimbursement cycles often span several weeks, it’s crucial that you identify issues as soon as payments post.

- Use Specialized Billing Software: Many practice management systems allow you to input your payer fee schedules. When a payment is posted, the software can alert you if the amount is lower than the contracted rate.

- Create a Payment Variance Report: This report compares actual payments against expected payments across all payers. Any variance beyond a certain threshold (e.g., 5% or 10%) triggers a deeper review.

- Train Your Billing Team: Educate coders and billing specialists on what to look for. This includes incorrect code combinations, abrupt changes in reimbursement patterns, or anomalies in explanation of benefits (EOBs).

- Establish a Timely Review Process: Payment posting should be done daily or weekly. Soon afterward, staff should generate and review variance reports to catch underpayments quickly. Prompt detection is critical; many payers impose deadlines for dispute submissions.

5. Steps to Identify an Underpayment

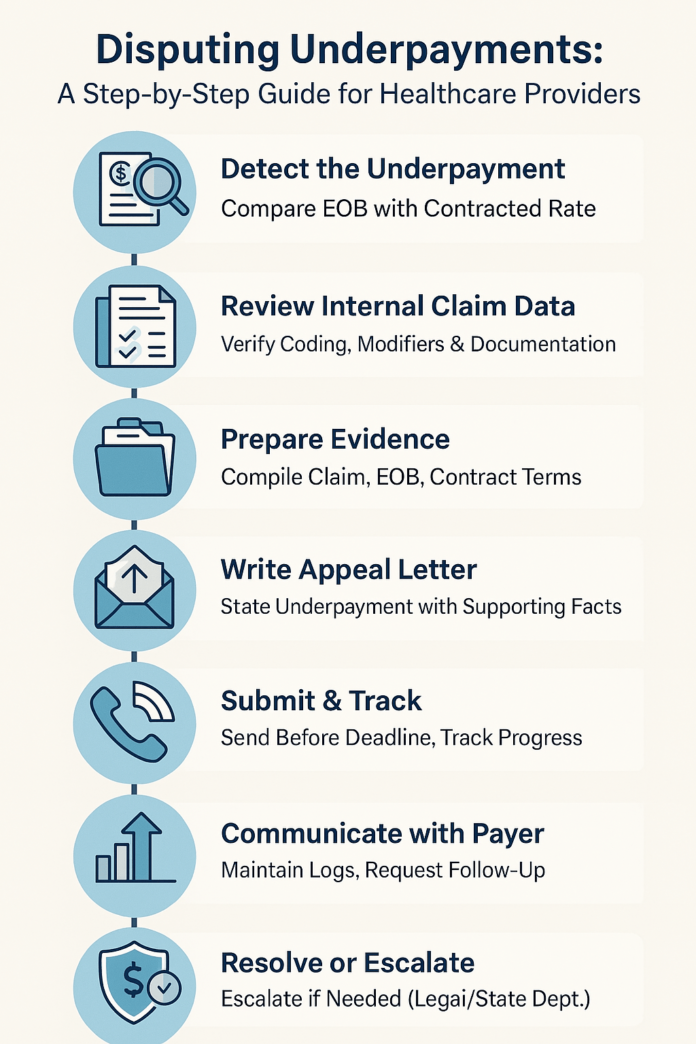

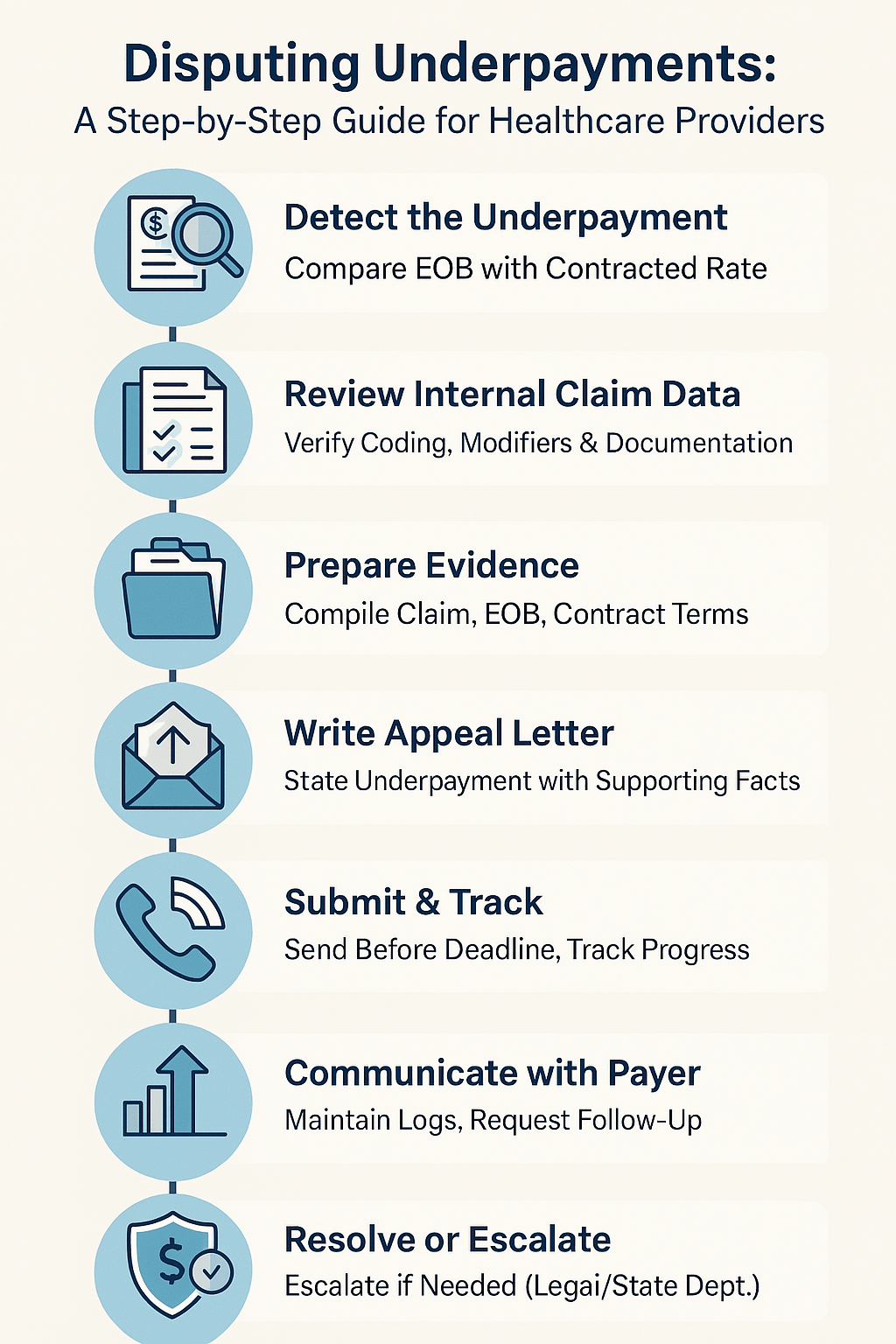

Once your systems and staff are poised to detect discrepancies, you can systematically handle each suspected underpayment:

- Compare EOB to Contracted Rate: Confirm if the allowed amount matches your payer contract or standard fee schedule. If it’s less, you may have an underpayment.

- Check for Payer Policies: Verify if the partial payment aligns with legitimate policies—like valid multiple-procedure reductions or medically necessary reviews. If there’s no justification, proceed further.

- Review the Claim Submission: Ensure that your billing codes, modifiers, and documentation are correct. If you spot any internal errors, you’ll need to correct and potentially resubmit.

- Assess Timely Filing: Confirm you submitted the claim within the payer’s filing deadline. Late filings are often only partially paid or not paid at all.

- Document All Findings: Keep an internal record of what you discovered. You’ll use this evidence if you choose to dispute or appeal the underpaid claim.

6. Crafting a Strong Dispute or Appeal

If you verify the claim has been underpaid in error, you should move to dispute resolution. A dispute can sometimes be as simple as a phone call, but complex underpayments often require a formal appeal letter and relevant documentation.

6.1 Gather Essential Documentation

You’ll need a clear evidence trail to support your dispute. This typically includes:

- Copy of the Original Claim: Show the codes, modifiers, and billed charges.

- Relevant Medical Records or Documentation: Highlight details that justify higher reimbursement or distinct procedures.

- Contract Excerpts: Cite the relevant sections of your payer contract or fee schedule that prove the correct reimbursement rate.

- EOB: Show how the payer calculated the reduced amount.

- Correspondence Records: If you’ve communicated with the payer regarding this claim, include letters, emails, or phone call logs.

6.2 Create a Formal Appeal Letter

Your appeal letter should be concise, direct, and well-structured. Consider these components:

- Claim Information: List patient details, claim numbers, dates of service, and provider ID for easy reference.

- Reason for the Appeal: State that this is an underpayment dispute. Identify the specific shortfall and reference the relevant contract clause or policy.

- Supporting Evidence: Summarize your evidence, referencing attached medical records or contract details.

- Desired Outcome: Specify the corrected payment amount you expect and request prompt reprocessing.

- Follow-Up Plan: Provide your contact details and set a timeframe for the payer to respond.

6.3 Pay Attention to Timelines

Most payers impose deadlines for dispute and appeal submissions—ranging from 30 to 180 days from the date of remittance advice. Missing these deadlines can forfeit your right to any additional payment. Therefore:

- Mark Calendar Reminders: or set automated triggers in your billing software to track each claim’s appeal window.

- Send Documents via Certified Mail: or through the payer’s online portal to confirm delivery.

7. Effective Communication with Payers

Disputes often require back-and-forth communication. While phone calls can sometimes resolve issues quickly, it’s vital to keep a paper trail.

-

Maintain Detailed Call Logs

For every call to the payer, record the representative’s name, date/time, reference number, and a summary of the conversation.

-

Utilize Email or Secure Messaging

If the payer allows, consider using written communication for clarity and accountability. Summaries of phone calls in writing can also help in further disputes or escalations.

-

Respectful but Firm Stance

Approach payer representatives professionally. Express courtesy, but reinforce that timely, accurate payment is a contractual obligation. Escalate to a supervisor if initial attempts stall.

8. Negotiation Tactics and Best Practices

In some cases, the payer may present a counterargument or partial payment concession. Skilled negotiation can bridge the gap, but you must remain well-prepared:

-

Rely on Data

Provide evidence that you’re being consistent with industry standards, usual and customary rates, or the specific language in your contract.

-

Cite Precedents

If you’ve had similar claims paid correctly in the past or if you’ve successfully appealed similar underpayments, highlight that precedent.

-

Be Open to Compromise, Within Reason

In certain situations, it might be beneficial to accept a slightly adjusted rate if that means a prompt resolution—especially for smaller amounts. However, weigh this against the risk of reinforcing payer habits of underpaying.

-

Maintain a Professional Tone

Aggressive or confrontational communication can create pushback, delaying resolution. Firm, data-backed arguments typically yield better results.

9. Escalating to Higher Levels or External Review

If a payer consistently refuses to correct underpayments, or if negotiations remain deadlocked, you may need to escalate:

-

Internal Payer Escalation

Request a review by a payer’s internal appeals panel or supervisor. Many payers have multi-level appeal processes.

-

Involve Your State Insurance Department

Some states allow you to file complaints against payers for failing to honor contractual obligations. If the payer’s conduct is especially egregious, a formal complaint or regulatory intervention might be necessary.

-

Legal Consultation

For recurring, large-scale underpayment disputes, consider consulting a healthcare attorney. Legal action can be a last resort, but it occasionally becomes necessary to enforce compliance with contracts.

10. Preventing Future Underpayments

While handling current disputes is crucial, preventing new underpayments is equally important. Consider the following proactive measures:

-

Regular Contract Audits

Review payer agreements at least annually. Confirm correct fee schedules, payment terms, and policy updates. If you find discrepancies, address them proactively with the payer.

-

Up-to-Date Coding Practices

Stay on top of code changes each year. Encourage ongoing staff education, and consider employing certified coders to reduce mistakes that lead to partial payments.

-

Regular Staff Training

Both administrative and clinical teams should understand documentation requirements, billing rules, and the process for challenging underpayments.

-

Invest in Analytics

Sophisticated revenue cycle platforms can generate real-time dashboards, so you can quickly spot anomalies. By identifying smaller patterns of underpayment early, you prevent bigger, systemic issues.

-

Leverage Professional Organizations

Entities like the American Medical Association (AMA), Medical Group Management Association (MGMA), or specialty societies often share best practices, policy updates, or sample letters.

11. Building a Culture of Accountability and Vigilance

Proper dispute management doesn’t happen in a vacuum—it requires a cohesive effort across your organization:

Share Success Stories

When you resolve an underpayment successfully, communicate the result to the entire team. This encourages vigilance and fosters a sense of shared accomplishment.

Recognize Efforts

Billing and coding professionals often tackle complex issues behind the scenes. Acknowledge their role in sustaining the practice’s financial well-being.

Open Communication Channels

Encourage staff to report suspicious payer behavior or unusual reimbursement patterns promptly.

12. Case Example: Successful Underpayment Appeal in an Orthopedic Practice

Imagine an orthopedic clinic that identifies repeated underpayments for knee arthroscopy procedures. The practice’s billing software flags a 15% discrepancy between actual and contracted payments. Here’s how the clinic handles it:

-

Verification

The billing manager checks the EOBs, noticing each claim is reimbursed 15% below the negotiated rate. No mention of bundling or policy changes.

-

Contract Analysis

The manager compares the contract’s fee schedule and confirms the correct CPT code. Everything aligns with the negotiated rate.

-

Formal Appeal

The manager compiles relevant contract clauses, includes a sample of EOBs, and writes a concise appeal letter.

-

Communication with Payer

After multiple phone calls, the payer concedes an internal system error—thus reprocessing the claims.

-

Outcome

The payer issues corrected payments within 30 days, reimbursing the shortfall across multiple claims. The clinic adds a monthly variance report focusing specifically on knee arthroscopy codes to monitor future trends.

This example underscores how vigilance, documentation, and a proactive approach can yield speedy and satisfactory resolutions.

13. Conclusion

Underpayments pose a real threat to any healthcare practice’s bottom line. They can slip through the cracks if not carefully tracked, analyzed, and appealed. By establishing a strong internal monitoring system, diligently reviewing each explanation of benefits, and systematically filing well-supported disputes and appeals, you can effectively safeguard your revenue.

Moreover, building and maintaining positive relationships with payers—while knowing when and how to escalate issues—ensures that your practice receives fair compensation for all services rendered. Finally, by emphasizing ongoing education, leveraging modern billing technologies, and fostering a culture of accountability, you position your organization to handle future underpayments with greater agility and success.

Implementing these strategies will not only improve your ability to recoup lost revenue but also instill confidence in your financial processes, ultimately allowing you to focus more on delivering high-quality care to the patients who need it most.